The Hartford Small Business Insurance Review

Last Updated on January 24, 2023

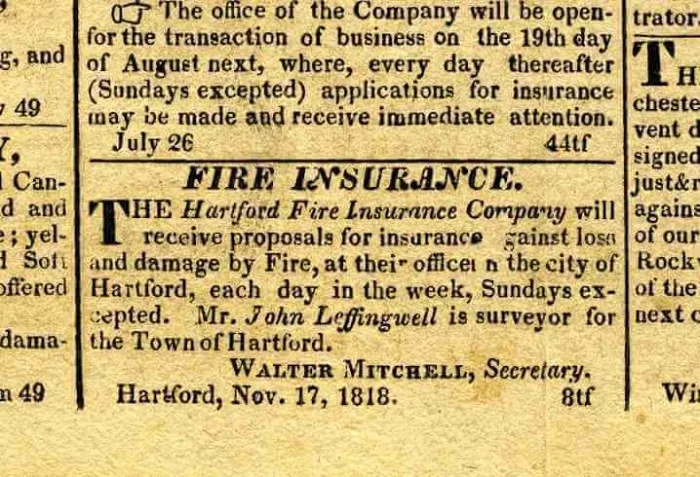

The Hartford is one of the oldest insurance companies in the world, having been founded all the way back in 1810. From its inception, the company was devoted to providing quality coverage for property owners, specifically first offering insurance for losses and damages from fires.

Photo Credit: The Hartford

Over the years, The Hartford has expanded its offerings to include a wide range of coverage types and developed a strong reputation within the industry. Today, they remain one of the most trusted names in insurance, with a commitment to always putting their customers first.

So, whether you are looking for coverage for your home, your car, or your business, The Hartford is an excellent choice that can help to protect what matters most.

In this The Hartford Business Insurance review, we will take a closer look at the company’s small business insurance, specifically evaluating its coverage options, availability, customer service, and overall value.

Table of Contents

Why Do Small Businesses Need Insurance?

Coverages Offered by the Hartford

How to Get a Quote from The Hartford

The Hartford’s Policy Benefits

How Much Do The Hartford’s Small Business Policies Cost?

The Hartford Small Business Insurance Rating

Three Alternative Insurers to The Hartford

Bottom Line

Why Do Small Businesses Need Insurance?

It is no secret that starting a small business can be a huge challenge. Business owners such as yourself already have to juggle the demands of managing a growing enterprise with keeping up with the latest innovations in your industry. These can take up a significant amount of time and energy.

In many cases, however, this is just the tip of the iceberg; in addition to these challenges involved in growing businesses, they too are often at the mercy of a variety of risks and challenges that could potentially jeopardize their operations. These take the form of macro-level issues to smaller problems specific to your industry.

For instance, unexpected economic shifts such as the one we experienced during the COVID-19 pandemic meant that a lot of business operations had come to a halt and many individuals and families lost a steady source of income. On the other hand, even recovering businesses today still have to deal with legal liabilities that result from unchecked actions such as injurious advertisements and common natural hazards that can damage important equipment and properties.

In short, there are many potential risks that small businesses have to face as they strive for growth. Small businesses are already vulnerable to economic fluctuations and changes in market conditions that can lead to decreases in revenue or profits, but there are other difficult situations they should be aware of such as business interruptions and third-party damages that could result in debts and unexpected expenses.

However, with the right insurance plan in place, owners of small businesses have the financial strength to protect themselves from the devastating effects of such. This practice has then become an essential part of running a successful enterprise as it also provides a safety net for your employees and assets.

Having a comprehensive plan gives owners such as yourself peace of mind and the ability to refocus their energy toward building a thriving company for the years to come. Be sure to get insured if you are not already.

Coverages Offered by the Hartford

There are different coverage options to address the multiple risks outlined above. The Hartford is particularly popular as they offer not just protection for businesses but for cars and homeowners. As mentioned, we will focus on their small business insurance offerings which are listed below.

Business Owner’s Policy: The Hartford’s Business Owner’s Policy includes commercial property insurance for your buildings, equipment, inventory, furniture, and fixtures, general liability insurance for damage to properties and/or harm to persons, and business income insurance for lost income as a consequence of a covered event. The company also allows owners of small businesses to include other coverages to their BOP such as data breach, professional liability, workers’ compensation, and commercial auto.

General Liability Insurance: General liability covers third-party injury whether that is in the form of bodily harm, slander, or property damage.

Workers’ Compensation Insurance: As the name suggests, this compensates workers should they become ill or get injured from their job, need medical attention and pay consequent medical expenses, and miss out on wages as a result of these.

Business Income Insurance: This replaces lost revenue when your business encounters an unfortunate but covered event such as a fire, flood, or even theft.

Commercial Auto Insurance: This type of coverage is designed for vehicles owned by your company and even ones you rent or lease. It includes bodily injury to other drivers, collision and property damage, comprehensive coverage from natural hazards, uninsured/underinsured motorist coverage, personal injury protection no matter who is at fault, and rental car and hired and non-owned auto insurance.

Commercial Flood Insurance: Through the National Flood Insurance Program, The Hartford affords protection to your commercial properties from harm caused by hurricanes, rain, snow melts, or even construction runoff.

Commercial Property Insurance: As included in the BOP, this covers protects all physical assets of your business from your building down to the fixtures within it. This can cover your inventory and the property you rent or lease and even cover lost revenue resulting from equipment that may be under repair or need replacement.

Commercial Umbrella Insurance: Much like an umbrella, this covers your businesses from costs that “flow over” your coverage limits.

Cyber Insurance: This is also called data breach and cyber liability insurance and covers exactly those that could result from theft and other data-handling issues.

Employment Practices Liability Insurance: This defends employers from employment-related claims by their employees such as those relating to discrimination, harassment, or wrongful termination.

Home-based Business Insurance: Specifically designed for owners who run their businesses from their homes, this offers additional coverage for properties such as data and equipment which are otherwise not included in a homeowners policy. This would be useful for self-employed individuals and sole proprietorships wherein homes and businesses are the same.

Management Liability Insurance: This type of coverage protects your organization from potential risks associated with the management team.

Marine Insurance: This protects your valuables whether they’re in transit by land, sea, or air. This would be useful for businesses that frequently ship or transport products.

Multinational Insurance: The Hartford’s Multinational Choice insurance plans offer key coverages for businesses that operate internationally or have overseas locations and/or employees.

Professional Liability Insurance: Also known as errors and omissions insurance, this covers professionals from negligent actions that result in a loss for their clients. This is important for professions that offer advice and professional services such as contracting, consulting, accounting, and legal work.

Beyond these coverages, The Hartford also provides other services such as risk engineering and loss control from their professionals wherein they tailor a plan for your unique needs, surety bonds to assure your customers that you will render your services, and a productivity advantage to coordinate the claims experience as well as enable an absence reporting solution for employers and employees.

Availability of The Hartford’s Coverages

While The Hartford has comprehensive coverage for a wide range of industries and business sizes and coverage for businesses operating overseas, not all of their offerings are available in every state.

Unfortunately, Alaska and New Jersey are currently off-limits for their services.

How to Get a Quote from The Hartford

Getting a quote from The Hartford is simple and straightforward, whether you choose to fill out an online form or speak to a representative over the phone.

With just a few minutes of your time, you can get a quote tailored to your specific small business needs online with the form option. If you prefer consulting before picking out your coverage options, The Hartford has representatives you can speak with through 855-431-1252 from 8 a.m. to 7 p.m. ET.

The Hartford’s Policy Benefits

As one of the biggest providers of business protection in the country, The Hartford has a long list of coverage offerings for businesses of any size. Below are some of the benefits of their specific policies.

The Significance of Multinational Insurance

Conducting business internationally or having international subsidiaries or employees can come with unique risks and is often not covered by traditional domestic policies. The Hartford’s multinational insurance provides coverage for the specific needs and potential liabilities of operating globally, including foreign workers’ compensation that need to align with local regulations and property damage that could happen in other locations.

Perks of a The Hartford’s Business Owner’s Policy

Catering to small businesses, The Hartford’s Business Owner’s Policy combines general liability, commercial property, and business income coverage into one convenient package. Unlike usual BOPs that only include general liability and commercial property, this offers a cost-effective solution for owners of small businesses as it saves money and simplifies the process of purchasing multiple coverages, with the option to include additional coverages such as cyber liability.

How Much Do The Hartford’s Small Business Policies Cost?

According to their website, the average monthly premium for a general liability policy from The Hartford costs $88 while a BOP costs $261 for small businesses. Additionally, business owners that pay out less than $300,000 in salaries monthly could expect to pay about $70 for a workers’ compensation policy.

Ultimately, pricing for policies can vary greatly depending on factors such as specific coverage options, industry, business size and payroll, location, and overall risk and experience as reflected in your claims history.

The best way to get an accurate quote is to fill out a form or speak with a representative from The Hartford.

The Hartford Small Business Insurance Rating

The Hartford Financial Services Group, Inc. is rated A+ (Superior) by AM Best in terms of financial strength. However, they are not accredited by the Better Business Bureau (BBB) which rates insurers based on their customer service and complaint statistics.

Making a Claim with The Hartford

Much like their quoting process, claims with The Hartford can either be done online through a form or by phoning a handler at 800-243-5860.

After submitting, policyholders can monitor their claim status through their accounts.

Three Alternative Insurers to The Hartford

Now that you know more about this company based in Connecticut, you may want to compare it with other insurers. This will help you understand how accreditation and other offerings stack up. Here, we detail three alternative business insurance providers to The Hartford.

Chubb

If you are based in New Jersey, Chubb may be the provider for you as their headquarters are located in your state. As mentioned, The Hartford is not available in NJ, so, this company would be more accessible to you.

Chubb also has a wider reach in general since it operates in 54 countries and caters to individuals, families, and businesses of all sizes. In fact, Chubb is the world’s largest publicly traded property and casualty insurance company and has been around for longer, with origins dating back to 1792.

As does The Hartford, they have services for risk engineering and solutions for multinational companies. Meanwhile, they offer more resources such as business income consultation and coverages such as political risk insurance against interstate conflict and failure in governance.

Geico

This Maryland-headquartered corporation is among the largest auto insurers in the United States. Beyond vehicle insurance, GEICO also provides property, business, and other forms of coverage such as those for pets, events, and travel. In short, this provider will have a coverage option for any risk you could encounter in your lifetime.

However, business insurance offerings from GEICO are limited to general liability, business owner’s policy, professional liability, workers’ compensation, medical malpractice, commercial auto, and cyber liability.

Travelers

Travelers is the most like The Hartford in that the company offers homeowners, auto, and business insurance, as well as coverages and solutions for small and large businesses, and was founded in the 1800s.

However, Travelers has a higher rating from AM Best with an A++ score in claims-paying and additional coverages such as environmental liability and boiler and machinery coverage designed specifically for equipment breakdown.

Bottom Line

Deciding on insurance coverage and providers can be a daunting task for small businesses. Whether you’re looking for general liability coverage or specialty policies for specific needs, there are countless companies to choose from.

When it comes to protection for small businesses, The Hartford has been delivering comprehensive coverage for hundreds of years and has been known to value people’s properties. Today, their policies are customized to meet the specific needs of your business, giving you both peace of mind and total coverage for you to concentrate on growing your business.

Whether you are a new or established company, their experts are here to help you navigate the sometimes-complex world of insurance. With The Hartford, you can rest assured that your small business is in good hands.