Next Insurance Review [2023]: Pros and Cons

Last Updated on April 27, 2023

If you’re a business owner, chances are, you already know that having the right and adequate business insurance is crucial to protecting your company. But where should you start your search with so many different policies and companies out there?

An option you may want to consider is Next Insurance, a provider based in Palo Alto, CA. They are among the leading insurance companies widely known for catering specifically to small businesses.

In this review of Next Business Insurance, we’ll take a closer look at this innovative company and its various policy offerings, as well as the pros and cons of getting a policy from them.

Table of Contents

Risks

What’s Next Insurance?

Pros and Cons

Coverage

Availability

Testimonials

Rates

Discounts

Claims

Next Alternatives

Bottom Line

FAQs

The Real Risk of Not Having Adequate Small Business Insurance

We get it—business owners are always looking for ways to cut costs. Nonetheless, going cheap is not advisable when it comes to insurance. And yet, many business owners believe that they don’t need it or that their coverage is inadequate. This oversight may be putting their entire operation at risk by not having reputational and financial protection against claims and lawsuits.

What needs to be highlighted here is that the potential dangers of not having adequate business insurance are numerous and varied. Perhaps the most obvious one would be the financial harm that could result from multiple factors such as medical fees, equipment replacements, vehicle repairs, or a lawsuit.

This is why different types of coverage from general liability, professional liability, commercial auto, and equipment insurance policies are available in the market to prevent your business from being on the hook for thousands or even millions of dollars.

If you don’t have it and something goes wrong, your reputation could take a major hit. Getting sued for negligence can easily become public knowledge, making it hard to get new customers. In some cases, the bad press might even ruin your business completely.

The best way to avoid these dangers is to make sure that you have comprehensive coverage for your business type and that it is adequate for your structure.

What is Next Insurance?

Next Insurance was founded in 2016 with the mission of making it possible for small businesses to get instant coverage. Next is committed to offering competitive pricing, comprised of experienced professionals, and tailored for over 1,300 industries and professions from restaurants and construction, to personal training.

In the following sections of this review, we will take a look at some pros and cons of Next Insurance and its offerings to help you decide if it is the right provider for your protection.

The Pros and Cons of Next Insurance

As mentioned, Next prides itself on being dedicated to small businesses. Because of this, they focus on simplicity and affordability, showcasing their array of products and lineup of professionals ready to help business owners get started on the process.

Specifically, they offer fast business online quotes with their artificial intelligence that allows you to access online policies, as well as a variety of discounts for bundled policies that can help you save money on your premiums. With Next business insurance, you can also get insured online and even share your certificate of insurance (COI) digitally with others.

Next is also an accredited member of the Better Business Bureau (BBB) with an A+ rating. They are rated 4/5 stars by customers on Trustpilot.

On the other hand, Next also has some cons you should consider before getting your small business insurance from them. For one, they are new to the industry and may not have the same level of experience as some of the more established providers. This will be further discussed in a later section where we compare it with other companies.

Secondly, their insurance solutions are only available in 48 states. Some customers have also complained that it can be difficult to get in touch with customer service representatives from Next and that the claims process can be slow and complicated. Therefore, it may not be as right for those who prefer access to a claims advocate.

Lastly, a policy from them may have higher deductibles compared to others.

Types of Coverage Offered By Next Business Insurance Company

Next offers a wide range of selections, including:

General Liability Insurance: General liability covers a broad range of risks including claims of bodily injury—”slip-and-fall”, as Next calls it—property damage, legal fees, medical payments, reputational harm, and advertising injury.

Worker’s Compensation Insurance: Workers comp covers employees’ medical expenses from examinations to treatments when they become ill or injured from their work. It even provides lost wages when an employee needs time to recover before going back to work.

Professional Liability Insurance: This protects you from professional liability such as claims from customers accusing you of negligence and errors and omissions in your work.

Commercial Auto Insurance: Commercial auto has you covered for any vehicle-related expenses such as towing, repairs, replacements, and injuries from collisions.

Commercial Property Insurance: Commercial property looks after the physical assets of your company and its operations, from your physical store to equipment that could break down and inventory that may get lost due to a fire.

Product Liability Insurance: Protects your business from liability if a product you sell causes injury or damage.

Business Owner’s Policy (BOP): This policy combines protection from general liability and commercial property insurance into one. It is a bundle popular among small businesses because it allows you to save money while having a policy that suits your operations.

Liquor Liability Insurance: A unique policy from Next is this coverage for liquor liability or any claims that businesses serving liquor may encounter. These include injuries to drunk customers and property damage resulting from intoxicated behavior.

Next Insurance Small Business Coverage Availability

Although Next has coverage options for a substantial number of professions, it is not available in all 50 states. Meanwhile, below are some of the professions and industries which can benefit from being insured by Next.

Professions and Industries Serviced by Next Business Insurance

1. Accountants: Errors and omissions coverage can protect accountants against miscalculations that could cost thousands of dollars and potentially lead to legal action. This type of indemnity can help cover the costs of defending yourself in court, as well as any damages that may be awarded to the plaintiff.

2. Architects: Professional liability insurance, also known as errors and omissions (E & O), helps protect architects from allegations of mistakes or errors in architects’ work.

3. Attorneys: Whether one is considered a good or bad attorney, having a liability policy can ensure protection from accusations of legal malpractice or any errors that may occur while rendering legal services.

4. Auto repair shops: General liability and commercial auto insurance can protect auto repair shops in the case of damages to customers’ vehicles as well as any injuries that occur within their physical business location. Next offers commercial auto and other packages that include garage keepers liability, faulty work, and commercial property.

5. Beauty salons: Insurance claims could pay for costly redos or refunds for business errors and customer dissatisfaction, as well as medical expenses for workers’ injuries. Specifically, commercial property or equipment insurance could cover repairs and replacements for assets such as your dryers and backwash units.

6. Business consultants: Having professional liability insurance is necessary for any profession that provides advice for clients, so business consultants need coverage for any claims of financial losses resulting from their services.

7. Cleaning services: Let’s say you’re a janitorial service and one of your employees accidentally breaks a vase while cleaning a client’s office. If the client decides to sue your company, commercial general liability insurance can help cover the cost of attorney fees and any damages that may be awarded. And if your employee injures himself/herself while performing his/her job, an indemnity policy could help pay for medical expenses and cover lost wages for when he/she is in recovery.

8. Construction companies – The most common insurance policies for construction companies are general liability protections, which cover damages or injuries that occur on the job site. Other important policies not to be overlooked for construction companies include worker’s compensation, property damage, and business interruption coverage.

What Past Customers Have Said

With these, below are some reviews to help you gain insight from real professionals and businesses who have shared about their experiences with the company.

Positive Next Reviews

One of the pros of getting a policy from Next is that they allow clients to purchase their policies online. The customer above is happy with their experience as they were able to learn about insurance offers from their computer.

On top of being able to go through the processes fully online, Next also does not impose policies on their clients and allows them to acquire only the coverage they need.

Complaints about Next Insurance

Nonetheless and as to be expected with any provider, Next also has negative reviews pertaining to their coverage and premiums.

For instance, this nonprofit company had its policy canceled by Next as this type is not covered by Next, but their premiums were not refunded.

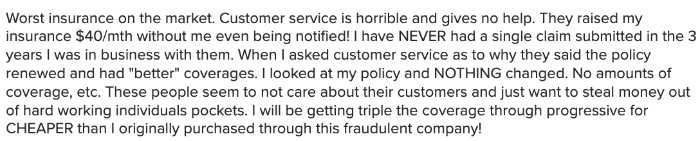

In contrast, the customer above is complaining about the lack of notice from the company about raising his monthly payments following the renewal of his policy.

How to Get the Best Rates from Next Insurance

With these in mind and some comments about Next’s premiums, how do small business owners get the best rates from them? Here are some tips:

- Window shop online marketplaces and compare rates from other companies. Reading our comprehensive reviews is a good place to start.

- Make sure that you understand what coverage you need and only purchase policies that are necessary for your business operations.

- Ask about discounts and see if you qualify for any. For companies such as Next, bundling packages could save you money.

- Read your policy carefully and make sure you understand your coverage limits. This will help you with the claiming process if needed.

- Keep your business records up to date and in good order. This will help the provider determine the proper premium for your business.

How much does Next insurance actually cost?

Next is a newer company that offers many features and benefits. They are quickly becoming a top choice for people looking for great coverage at an affordable price.

There are a variety of factors that will affect your premium, such as your profession, the state you operate in, and the type of coverage you need. However, you can rest assured knowing that Next is very competitively priced. For instance, a low-risk business could get general liability insurance with Next for as low as $11 a month.

To get a better idea of how much your policy might cost, be sure to get a free online quote today or call and speak to a knowledgeable agent.

Next Insurance Discounts

Next offers a variety of discounts that can help small business owners save money on your premiums, including:

1. Multi-Policy Discount: You can receive a discount on your premium if you purchase more than one policy from Next.

2. Paid-in-Full Discount: Paying your entire policy premium upfront can get you a discount.

3. Paperless Discount: You can sign up for paperless billing and payment options for additional discounts.

4. Early Bird Discount: Renewing your policy early could help you receive a discount on your premium.

5. Loyalty Discount: Clients who have been with Next for multiple years could get discounts!

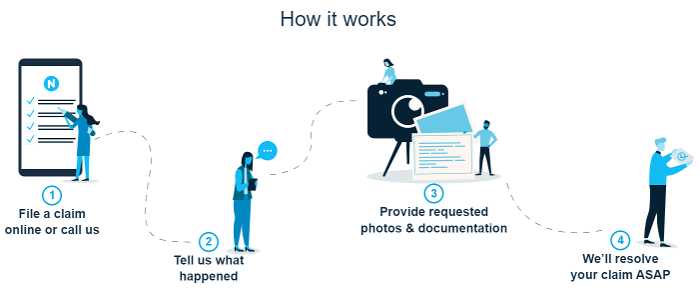

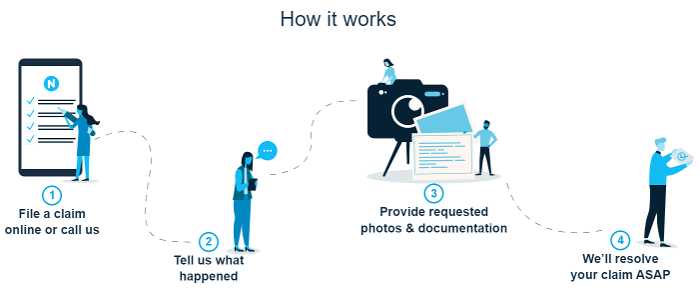

What to Do If You Have a Claim With Next Insurance

You can file a claim online or by calling the Next claims department at 1-855-563-5465. Once your claim is filed, it will be reviewed by an adjuster and a decision will be made regarding coverage and payment.

Next Business Insurance Alternatives

Small business owners have many providers to choose from when it comes to getting insured. Aside from Next, here are a few alternatives you may consider:

Simply Business

Simply Business is a business insurance broker that caters to all business sizes and allows clients to browse and purchase policies online. Besides small businesses, they also provide coverage to landlords and other businesses and professions such as personal trainers and freelancers.

Simply Business offers protection for public liability, professional indemnity, employers’ liability, and more. On their site, you can easily find a policy that will suit you based on your business type or trade. Read our full review on Simply Business Insurance.

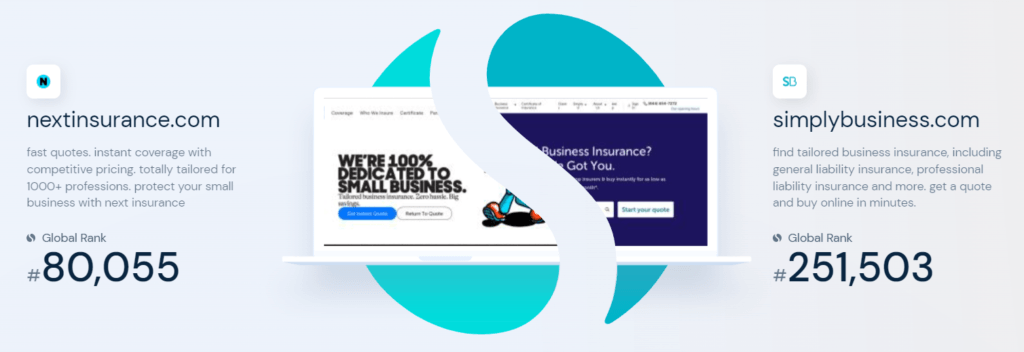

Next Insurance vs Simply Business: Which is better for your small business?

Next and Simply Business are both small business insurance brokers that offer a variety of coverage options. They both have their pros and cons, so it’s important to compare them side-by-side to see which is the best fit for your business.

Next specializes in small businesses, instant online quotes, and making the policy purchasing process swift and all online. They have a variety of discounts for customers that encourage them to customize and bundle policies to save on premiums.

Simply Business offers a variety of selections for varying self employed professionals, business sizes and types. They allow you to find and purchase tailor-made policies depending on your industry and trade just by answering a questionnaire on their site.

Hiscox

Hiscox is an international and long-standing insurance company that lays out multiple coverage choices, including property damage, general liability, errors and omissions, medical malpractice, and more. Like other traditional companies, their experience of over 100 years in the industry has established valuable trust among clients.

Next Insurance vs Hiscox: Which is better for your small business?

Below is a brief comparison of Next Insurance and Hiscox:

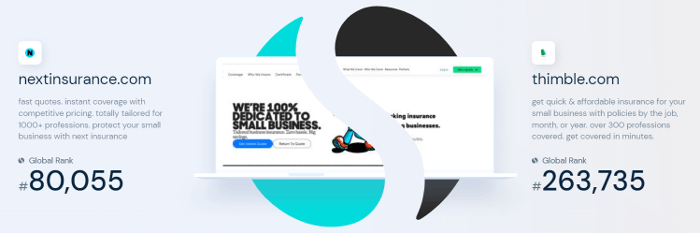

Built to meet the demands of modern businesses, Next focuses on its web solutions and AI technology to give its potential clients and existing customers quotes in just a few minutes and easy claiming processes, respectively. They have different types of coverage options for over 1,000 professions and businesses, as well as discounts to help you save money. Since their establishment in 2016, they have served over 300,000 customers.

As mentioned, Hiscox prides itself in its experience in the industry. Since its origins in 1901, the company has served over 800,000 customers with their multiple offices across the U.S. They’re a company that specializes in niche product solutions from knowledgeable agents having considerable expertise in many market sectors.

Thimble

Lastly, Thimble is a digital insurance company that offers on-demand policies for fast-moving small businesses and self employed entrepreneurs. Their policies are designed to be flexible enough for fitness trainers to dog walkers and allow you to customize your coverage to meet your specific needs within minutes. Jump on over to our breakdown review of Thimble Insurance.

Next Insurance vs Thimble: Which is better for your small business?

While both Next and Thimble were established in 2016 and are known for digitizing and streamlining business insurance products online, they too have their differences listed below:

Next is powered by their AI technology and team of professionals to get back to potential clients and customers within 48 hours. They also offer instant digital certificate of insurance (COI) access.

Thimble especially helps new professionals and businesses get started with their insurance options. They make the process less intimidating by offering policies by the job, month, or year, with no hidden fees, and with the possibility of canceling instantly.

The Bottom Line

All in all, Next Insurance is a solid choice for those looking for instant coverage at an affordable price. The company offers a wide range of solutions, and its customer service is top-notch because of its team and technology.

If you’re interested in getting a free online quote from the company, visit Next today.

FAQs about Next Insurance

Is Next Insurance legit?

Yes, absolutely! Next Insurance has been around nearly 8 years, with over 1,000 employees, and is headquartered in Palo Alto, California. They are also backed by Munich Re, a top reinsurer, making them a financially stable company.

How does Next Insurance work?

Next is an online insurance provider that offers quotes, coverage, and approval times for its customers whether a part time personal trainer or full time small business owner. The company website provides a range of services and tools to help customers find the right policy for their needs. Customers can get a quote from the company website or by contacting a Next agent.

Coverage is based on the customer’s needs and the type of policy they select. Approval times vary depending on the policy selected and the customer’s specific circumstances. We sincerely hope you found this breakdown helpful and a true complement to other small business insurance reviews.