Simply Business Insurance: Is It Any Good in 2023?

Last Updated on May 2, 2023

Starting a small business is an exciting endeavor. For many people, it’s a dream to see their unique idea come to life and grow into something special. Small businesses also come with many perks such as being your own boss and being able to call the shots when it comes to what your business does, how it does it, and where it goes.

However, this venture is not without its challenges. It takes hard work, dedication, learning, and a lot of thinking ahead to become successful. And, if you’re lucky enough, the rewards can be well worth the effort.

This is why one of the first steps on your list must be to get insurance. Not only is it required in most states and a necessity for customers and partners, but it also helps you secure your assets especially since accidents can happen at any time.

In this Simply Business review, we will be looking at this company to help small business owners such as yourself get an idea of whether or not a policy from them is any good in 2022.

Table of Contents

What’s Simply Business Insurance?

Coverage

Cost

Alternatives

FAQs

What’s Simply Business Insurance?

Simply Business is a UK-based provider with offices in Boston and London. They specialize in assisting small businesses and professionals by providing coverages such as professional indemnity and employer’s liability insurance, as well as landlords by offering tenant default and rent guarantee insurance.

They are among the largest insurers in all of the United Kingdom and highlight the simplicity, choices, and value that they deliver to their customers.

Why Get Insurance?

All business owners are driven by their goals. However, since we are only human–accidents, errors, disputes, and unforeseen hurdles are almost unavoidable in our work. And especially in the case of small businesses and professionals like you who have limited resources, insurance could help cover your bases, protecting you from the long list of things that could go wrong in your operations and the financial harm that tends to go along with them.

Specifically, professionals are held to a high standard of care. If you make a mistake, provide incorrect advice or mishandle the review of confidential information, your client could hold you liable. In this case, coverage in the form of professional Indemnity insurance protects you financially if you are accused of negligence or professional misconduct, even if the allegations turn out to be unfounded.

Furthermore, if you’re a landlord, having it is important because it protects you against loss of income if your tenant falls behind on paying their rent.

Types of Insurance Coverage

Below is a snapshot review of insurance offered by Simply Business that will help you understand what they are and if you may need them.

Public liability insurance: Businesses located in high-risk areas where property damage or bodily injury may be incurred by visitors, customers, and others on their property are often required to obtain public liability insurance (PLi, PL or liability insurance).

Professional indemnity insurance: PI, for short, can protect you from costly client lawsuits if your business provides consulting or aid with financial or legal matters. Claims usually ensue when a client endures a financial loss after availing of your services and needs compensation or seeks a legal proceeding.

Employer’s liability insurance: This policy is typically required by law for companies that employ one or more people. As an employer, this can help you avoid the expense of both past and present employee compensation claims if they are injured or become ill as a result of your company’s operations.

Tools insurance: If you’re a tradesman or any kind of skilled worker and rely on your tools for work, tools insurance will help pay for the replacements and repairs of your tools which may have been damaged by nature, during operations, or lost due to theft or misplacement.

Business contents insurance: It protects you from damage or loss to office furniture, equipment, and other assets to your business which may be due to theft, vandalism, flooding, or fires.

Business building insurance: More popularly known as commercial building insurance , is there to help cover repair or rebuild your business property in the event that they become damaged due to nature such as storms or by people such as through vandalism.

Shop insurance: This coverage combines public liability, product liability, and employers’ liability to cover the general risks faced by shops or small businesses. This coverage will protect you if your shop or your products cause injury or property damage to others, as well as if any of your employers get while on duty.

Small business health insurance: This policy offers medical coverage for you and your workers. It provides you with quick access to healthcare if anyone gets sick or injured.

The best way to ensure that you are getting the most value for your money is to do your research and review different insurance policies to find one that fits your unique needs.

Landlord Insurance Coverages

Buy-to-let insurance: Buy-to-let building insurance is designed for properties bought specifically for renting and protects these from damage from nature such as winds or man-made hazards such as a fire.

Landlord contents insurance: Some rental properties are furnished and are at risk of damage or loss, so this solution is here to cover rental property owners when it comes to safeguarding things “not fixed” within their properties such as kitchen appliances, all the way to decorative items.

Loss of rental income insurance covers your rental income if something exterior, like a fire or flood damage, makes it uninhabitable.

Landlord liability insurance: Also known as property owners liability insurance is just like public liability, but for landlords. If a landlord’s rental property causes someone injury or property damage, this coverage will help him/her pay for the legal or medical costs.

Accidental damage insurance: Accidents occur when we least expect them, and this type of coverage is designed to financially protect landlords from the cost of replacements or repairs of their properties that may otherwise be their responsibility to pay for as owners.

Alternative accommodation insurance: If a fire, flood, or other covered event causes severe damage to your property, this worthwhile protection might help you pay for the cost of housing your tenant(s) somewhere else.

Unoccupied property insurance: Also known as empty house insurance, this covers liability costs if your empty property is associated with an injury or property damage and can also cover damage to both the structure of your building and the contents within it.

Rental default insurance provides landlords with backup if their renters fail to make their payments.

Availability

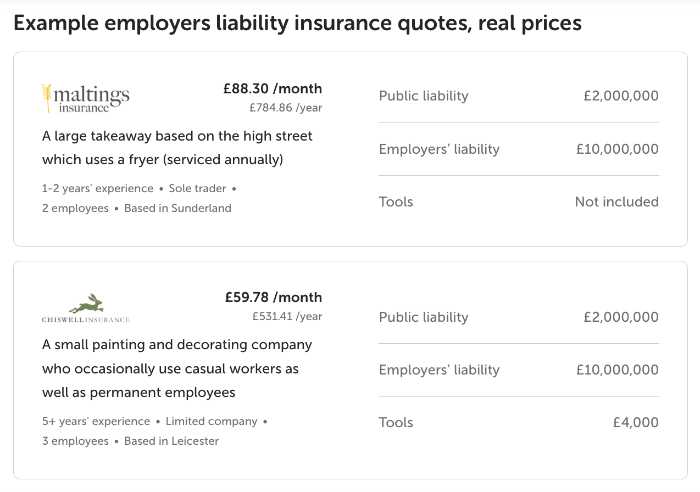

Although a UK-based company, Simply Business is partnered with many trusted providers such as Hiscox, AXA, Zurich, AIG, RSA Insurance, Maltings Insurance, NIG, Chiswell Insurance, Ageas, and Finsbury Insurance Group to offer their insurance products to many areas across the globe.

Getting a Cost Quote

Simply Business claims to get you a tailored policy within 7 minutes by answering questions about your business, employees, and coverage options.

To get an online quote from them, simply click “Start your quote” on their landing page or email contact@simplybusiness.co.uk if you prefer to do it online. Alternatively, you may call them at 0333 014 6683.

Their coverage pages also make it easy for you to compare the prices of other products across different partner companies to help you get a better idea of what you could end up paying for.

Advantages of Small Business Health Insurance

As a small business owner, you may be wondering if health insurance is worth the cost. However, there are actually several advantages to having health insurance for your small business.

First of all, if you or an employee gets sick or injured, private healthcare can give you quick access to healthcare professionals and save you time when it comes to waiting for diagnosis and undergoing treatments. This means that you can get back to work and make money sooner.

Another advantage of having health insurance for your small business is that it can help attract and retain good employees. Employees who know that they have access to good quality healthcare through their employer are more likely to be loyal and stay with the company for longer.

How is Landlord Insurance Different from Homeowners Insurance?

Landlord insurance is designed to protect property owners who rent out their homes. While homeowners insurance also provides coverage for the dwelling itself, landlord policy additionally covers such things as loss of rent and damage caused by tenants.

Homeowners’ insurance typically does not cover any damages sustained by renters, so it’s important for landlords to have both types of coverage in place. In the event that a tenant causes damage to the rental property, it will help pay for repairs or replacement costs. If a tenant unexpectedly moves out and leaves the rental unit vacant, landlord insurance can also help cover lost income from missed rental payments.

While homeowner policies vary in terms of what they cover, most do not provide any type of protection for landlords renting out their homes. For this reason, landlords need to review and purchase a separate policy that specifically covers their needs. Landlord insurance can help give you peace of mind in knowing that your property is protected, even if something unforeseen happens with your tenants.

Simply Business Testimonials

With everything we have covered thus far, now would be the best time to look at some reviews from past and present clients of Simply Business to guide you in what others appreciate about them, and, of course, some complaints which may include features that are non-negotiables for you.

Positive Customer Reviews

This landlord was able to share all the details he needed for his repair online upon encountering a leak within his property that is covered by his policy. He gave Simply Business a five-star rating and says he recommended the company to his peers.

This recent customer was happy about the knowledge imparted to him by the Simply Business team when it comes to the insurance he needed.

Poor Reviews

Simply Business values customer reviews and offers Amazon gift cards for those who leave feedback. However, some customers have complained about not getting their reward and having to wait days before a representative gets back to them.

This customer left a bad review for Simply Business after being uninformed about the auto-renewal of her policy and additional fees when it came to canceling her insurance.

Alternative Providers

Now, as much as you already know about Simply Business, shopping around to review other companies is important for making sure that your provider services your area, offers the policy needed for your business type and size, and is within your budget. As such, here are three other options and how they compare to Simply Business:

What is biBERK Insurance?

biBERK Insurance is an online small business provider that is part of the Berkshire Hathaway Insurance Group founded by Warren Buffett. Started in 2015, biBERK offers a variety of solutions to help small businesses protect themselves and stay in compliance with state laws.

Some of the products that biBERK offers include errors and omissions, commercial auto, umbrella, and cyber insurance. You may read our full review on biBERK Small Business Insurance for more details.

biBERK Insurance vs. Simply Business

While both biBERK and Simply Business offer a variety of insurance products for small businesses, there are some key differences between the two companies.

For one, biBERK is focused on providing policies for small businesses in the United States, while Simply Business is based in the United Kingdom and also offers coverage for landlords. Another difference is that biBERK offers its insurance products entirely online, while Simply Business has a mix of online and offline options.

Finally, pricing varies depending on the type of coverage you’re looking for, but biBERK is generally may be more expensive than Simply Business.

The bottom line? If you’re looking for small business insurance in the United States, biBERK is a good option to consider. However, if you’re based in the UK or are a landlord, Simply Business may be a better fit for you.

What is THREE Business?

THREE Business is a service provider offering an all-in-one policy that features the most popular types of coverage for small businesses to make getting insured uncomplicated. They were founded in 2019 and is a Berkshire Hathaway Direct Insurance Group company as is biBERK.

Included in their all-in-one policy is business liability, business interruption, cyber, worker’s compensation, business auto, and property and assets insurance. Check out our THREE Business Insurance review to find out more.

THREE Business vs. Simply Business

There are a few key differences between THREE Business insurance and Simply Business insurance.

First, THREE Business offers an all-in-one policy which may be more attractive if you are a small business owner wanting a simple and seamless experience. However, Simply Business may be the better option if you would like to choose your specific coverage or if you are a landlord.

Second, THREE Business is located in the US while Simply Business is located in the UK. This may be a deciding factor for some customers depending on their location and preferences.

Thirdly, THREE is a newer company founded in 2019 while Simply Business had been around since 2005 so Simply Business may have more experience working with more types of industries.

What is InsuranceBee?

InsuranceBee is an insurance provider that provides coverage for independent consulting firms and freelance professionals. With their tagline “Liability insurance with a personal touch”, they claim to understand that the traditional system does not provide suited coverage for these sorts of enterprises, so policies from InsuranceBee are designed specifically for freelancers and consultants. Learn more about coverage options of InsuranceBee in our detailed review.

InsuranceBee vs. Simply Business

Both InsuranceBee and Simply Business offer insurance for independent professionals. However, InsuranceBee may understand their needs more as they specialize in this industry, while Simply Business has more options for other trades and businesses.

The Bottom Line

Different types of insurance coverage are available because of the vast array of businesses around in this age. Then, it is important to have a competent understanding of these types of coverages to ensure that you get the right policy for your business and more or less have an idea of which company will be able to provide this for you.

Simply Business offers comprehensive options from independent professionals, caterers, and tradesmen, to those renting out their properties for income.

FAQs about Simply Business

What is Simply Business’ rating?

Simply Business has a 4.1/5 rating on Glassdoor and 4.2/5 rating on Trustpilot. They have been accredited by the Better Business Bureau since 2020 and are a B Corp meaning they have met high standards for valuing society and the environment.