Advantages of Product Liability Insurance for Your Small Business

Last Updated on June 16, 2023

OUTLINE

What is Product Liability Insurance

Importance

Who needs it

What it covers

Cost

Get a quote

PLI companies

Risks

Conclusion

FAQ

Running a small business can be incredibly challenging. There are so many things to think about and keep track of, from inventory and finances to marketing and customer service. It can be difficult to stay organized and keep everything running smoothly, especially if you’re doing it all yourself. And when things do go wrong, it can be hard to find the time and resources to fix them.

But despite all the challenges, running a small business can be an incredibly rewarding experience. It’s a chance to be your own boss, build something from scratch, and make a difference in your community. And when things go right, it can be a real source of pride.

One of the most important things to think about when running a small business is business insurance. This is something that can often be overlooked, especially in the early stages of starting a business. But if something goes wrong, having adequate business insurance can mean the difference between the survival and the failure of your business. Let’s deep dive into the advantages of product liability insurance.

What is Product Liability Insurance?

Product liability insurance is a type of business insurance that protects businesses from being held liable for injuries or damage caused by their products. This can include but are not limited to:

Manufacturing defects – when a product is not made correctly and causes injury or damage as a result

Design defects – when there is something wrong with the design of a product that makes it dangerous

Warning defects – when a product does not have adequate warnings or instructions, and someone is injured as a result

Design flaws – any error in the design of a product that makes it dangerous

Product liability insurance can help protect businesses from these and other risks. It can

cover the cost of legal fees, settlements, and judgments against the business. It can also help cover the cost of repairing or replacing damaged products.

Product Liability vs General Liability Insurance

Product liability insurance is just one type of business insurance. There are also other types, such as general liability insurance. So, what’s the difference between the two?

General liability insurance is a type of business insurance that protects businesses from being held liable for injuries or damage that they cause. This can include but is not limited to:

Bodily injury – when someone is injured as a result of the business’s actions

Property damage – when someone’s property is damaged as a result of the business’s actions

Personal injury – when someone is injured as a result of the business’s actions, such as defamation or slander

General liability insurance can help protect businesses from these and other risks. It can cover the cost of legal fees, settlements, and judgments against the business.

Product liability insurance is similar to general liability insurance, but there are some key differences. Product liability insurance specifically covers injuries or damage caused by a business’s products. General liability insurance, on the other hand, covers injuries or damage caused by the business itself.

For example, let’s say that you own a small business that sells products. If one of your products breaks and injures someone, then product liability insurance would cover the cost of the damages. But if someone slips and falls in your store and is injured, then general liability insurance would cover the cost of the damages.

Another key difference is that product liability insurance typically covers manufacturing defects, design defects, and warning defects. General liability insurance, on the other hand, typically does not cover these things.

So, which one do you need? The answer depends on your business. If you sell products, then you will need product liability insurance. If you don’t sell products, then you might not need it.

Why is Product Liability Insurance So Important?

Product liability insurance is important because it can help protect businesses from the financial ruin that can come as a result of a product liability lawsuit. These claims may be extremely costly, and they frequently result in the closing of businesses. Even if you win the lawsuit, the legal fees can be astronomical.

Product liability insurance can help protect you from these risks. It can give you the peace of mind knowing that you’re covered in case something goes wrong. It can also help you sleep better at night knowing that your business is protected.

Who Needs Product Liability Insurance?

Product liability insurance is important for any business that manufactures, distributes, or sells products. This includes businesses of all sizes, from small businesses to large corporations. If your business deals with any type of product, it’s important to have adequate product liability insurance.

Some businesses that may need product liability insurance include:

Clothing stores – if you sell clothes, you could be held liable if someone is injured by a defective garment

Toy stores – if you sell toys, you could be held liable if a child is injured by a toy that’s a swallow hazard

Furniture stores – if you sell furniture, you could be held liable if someone is injured by a poorly designed piece of furniture

Sporting goods stores – if you sell sporting goods, and someone is injured because of a defective piece of equipment, you could be legally responsible.

Home improvement stores – if you sell products that are used for home improvement, you could be held liable if someone is injured while using them.

Electronics stores – if you sell electronics, you could be held liable if someone is injured by a defective product

These are just a few examples of businesses that may need product liability insurance. If your business deals with any type of product, it’s important to have adequate coverage.

What Product Liability Insurance Covers

Product liability insurance can help protect your small business from the financial ruin that could come as the result of a lawsuit alleging that one of your products caused someone harm. This type of insurance can help cover the costs of defending against such a lawsuit, as well as any damages that may be awarded if you are found to be liable.

There are a few different types of product liability coverage that you may want to consider for your business, depending on the products you sell. One type of coverage is designed to protect against claims that your product was defective in some way, while another type can help cover the costs if someone alleges that your product caused them an injury.

No matter what type of product liability coverage you decide to purchase, it is important to make sure that it meets the needs of your particular business. You should work with an insurance agent or broker who understands the risks associated with your products and can help you find the right coverage for your business.

Cost

The cost of product liability insurance will vary depending on a number of factors, including the type of products you sell, the manufacturing process, the materials used, and the number of claims that have been made against your business in the past.

In general, businesses that manufacture products that are more likely to cause harm or that have a history of product liability claims will pay more for their coverage than businesses that sell safer products. Even if you are confident in the quality of your product, accidents can happen. One faulty product can lead to a lawsuit that could cost you everything you’ve worked for.

It is important to shop around and compare rates from different insurance companies before making a purchase. You should also consider the deductible you will be required to pay in the event of a claim. A higher deductible may mean a lower premium, but it could also leave you with more out-of-pocket costs if you are ever faced with a lawsuit.

Two Companies That Sell Product Liability Insurance

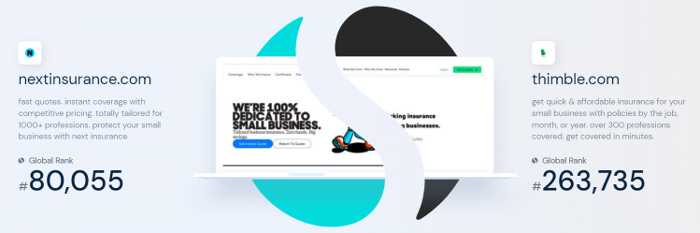

There are many different types of product liability insurance, and two companies that sell this type of insurance are Next Insurance and Thimble. Product liability insurance is important for small business owners, as it can protect them from lawsuits if their products cause injury or damage.

Next Insurance vs. Thimble

Next Insurance offers a variety of product liability insurance policies, and they have an online quote tool that makes it easy to get a quote. Thimble is a bit different, as they offer two coverage options. The first is a general liability insurance policy that includes PLI.

The second is an on-demand product liability insurance solution by the hour or day. This can be a good option for businesses that only need coverage for a short period of time, such as when they are exhibiting at a trade show.

Both Next Insurance and Thimble have good customer reviews and are worth considering if you are shopping for product liability insurance. Next Insurance may be a better option if you need a variety of coverage options. If you only require coverage for a short period, Thimble might be a smarter option. Check out our in-depth Next vs. Hiscox vs. Thimble review.

Get a product liability insurance quote online…in minutes

You don’t need an appointment or a meeting to get a quote for product liability insurance. You can do it all from the comfort of your own office-or even your home. And it only takes a few minutes.

Getting a quote is easy: just enter some basic information about your business and the product you want to insure. Then, compare quotes from multiple insurers to find the best coverage for your needs.

So why wait? Get a quote today and see how easy it is to protect your business with product liability insurance.

Risks of not having product liability insurance

Product liability insurance protects your business from lawsuits stemming from injuries or damages caused by your products. Without it, you could be on the hook for hundreds of thousands of dollars or more.

Consider these real-world examples:

In 2016, a woman in California was awarded $70 million in a product liability lawsuit against Johnson & Johnson. The woman claimed that the company’s talcum powder caused her ovarian cancer.

In 2014, General Motors was hit with a $1.2 billion product liability lawsuit over faulty ignition switches in its vehicles. The lawsuit claimed that the defect led to at least 124 deaths and 275 injuries.

These are just two examples of the costly lawsuits that can arise from product defects. If you don’t have product liability insurance, you could face financial ruin if something goes wrong with your product. Protect your livelihood by securing a policy that adequately covers your business from irreparable damages.

Conclusion

Product liability insurance is important for businesses of all sizes. It can protect your business from costly lawsuits and settlements, and help you cover the costs of product recalls. If you sell products, it’s important to make sure you have the right coverage in place. The cost of product liability insurance is a small price to pay for the peace of mind it can provide.

When James, a machinist, started his small business, he never thought he would need the protection product liability insurance provides. But then one of his products malfunctioned and injured a customer. If James didn’t have product liability insurance, he could have lost everything. Luckily, his policy covered the cost of the lawsuit and the settlement, and he was able to keep his business afloat.

Product liability insurance is important for businesses of all sizes. It can protect your business from costly lawsuits and settlements, and help you cover the costs of product recalls. If you sell products, it’s important to make sure you have the right coverage in place. Get a quote today and be prepared for whatever comes your way.

Suggested Reading

Errors and Omissions Insurance: A Protective Small Business Shield

Yes, Small Business Pros Need Professional Liability Insurance (PLI)

Why Your Business Needs Commercial Auto Insurance

Business Owners Policy (BOP) Insurance Shields Against Financial Losses

Workers Compensation Insurance Decoded

The Importance of Data Breach Insurance for Small Businesses