Hiscox Insurance Review [2023]: Pros vs Cons + Alternatives

Last Updated on January 19, 2023

Being insured is essential for any small business owner. It reduces vulnerability to many risks and gives a sense of security from financial harm. However, finding adequate coverage and the right insurance provider may be time-consuming for today’s busy small business owners.

That is why, in this Hiscox business insurance review, we will be reviewing its background, looking at its pros and cons, offers, and how it fares when compared to other insurance companies to help you decide if it’s a good fit for you!

Table of Contents

Overview

Risks

Coverage

Get a Quote

Policy Benefits

Cost

Customer Reviews

Rating

Claims

Hiscox Alternatives

Bottom Line

Hiscox Insurance Review Overview

With their tagline “encourage courage”, Hiscox Business Insurance has been a leading specialist insurer, especially for small enterprises as they offer a range of options to suit the needs of varying sizes. Moreover, they also offer customizable coverage so companies can review and tailor their insurance policies exactly to their business type.

And when it comes to reputation in the industry, Hiscox prides itself on having received good reviews for its customer service and claims handling. But, there are some drawbacks to Hiscox. One notable downside is that their premiums for business insurance can be on the high side, especially for certain types of coverage.

Overall, while Hiscox is a good option for insurance for small enterprises as you will learn from the rest of the review article, it may be worth taking a closer look at the company before making a decision. Now, let’s dive into the details.

Risks of not Having Small Business Insurance

Enterprises such as yours face a variety of risks every day—from the possibility of a customer slipping and falling on your premises, to your computer system failing. In short, countless disasters could occur, and a business owner like you can never be too safe when operations must continue. And without adequate protection, you could be facing some serious financial trouble.

Particularly, some of the risks uncovered in our review you might encounter include:

- Property damage: Whether it’s from an act of nature, someone’s action, or mere negligence, business properties could get damaged or even destroyed. Take, for example, your office may catch fire, suffer extensive water damage from a burst pipe, or even require repairs due to theft or vandalism.

- Liability: As customers frequent your after hours pub, you might be held responsible for any injuries caused to a third party if they occur at your business location. If a customer slips and falls, you may be sued.

- Equipment failure: The components of a system can break down or be damaged, preventing it from functioning as planned, which might disrupt operations.

- Business interruption: The possibility of closing your small business temporarily exists. This may be due to the need for maintenance, particularly following property damage.

In these instances, insurance can help your company cover the cost of repairs and replacements, legal expenses, and even lost income provided that it is from a covered event. And while you may not be able to completely protect yourself from all potential liabilities, having the right backing can help you prepare for them and reduce their impacts in the event of an accident—or worse, a lawsuit.

Hiscox Small Business Insurance Review Coverage

With this, here are some of the specific types of coverage offered by the Hiscox group:

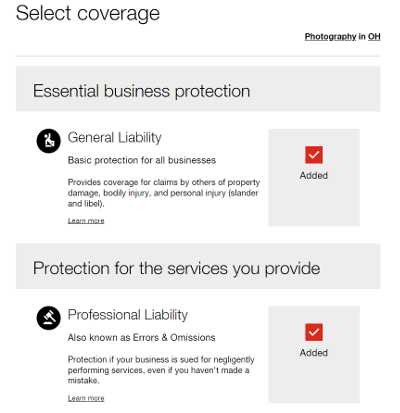

General liability insurance: General liability covers common risks such as third-party claims of bodily injury or property damage, as well as other damages that may result from the products or services that you offer.

Professional liability insurance: This protects businesses from claims relating to professional liability, such as actual or alleged negligence and errors, in the services or products they offer.

Business owners’ policy: A business owners’ policy (BOP) bundles together general liability and property insurance, providing comprehensive protection for your company.

Commercial property insurance: As the name suggests, commercial property covers damages to business properties, including the building itself and the contents inside.

Cyber security: Cyber insurance protects you from cybercrime, including data breaches, cyber extortion, and cyber vandalism.

Medical malpractice: This defends those in the healthcare industry from claims of bodily injury, sickness, or even death resulting from failure or error in rendering medical services.

Workers’ compensation: Commonly referred to as “workers comp”, this type is required in most states if you have employees, and it covers work-related injuries, illnesses, and death.

Short-term liability: Short-term liability policy offers you protection for a specific period whether it’s by the hour, days, or even months.

As you can see from this coverage review, Hiscox offers a wide variety of options to choose from. Whether you need basic liability coverage or a tailor-made solution, Hiscox has you covered.

Hiscox Offers Small Business Insurance in Which States?

At the time of review, Hiscox business insurance is available 49 states (Sorry to those who operate in Alaska!). Therefore, no matter where your business is located, Hiscox will (almost) always have what you are looking for.

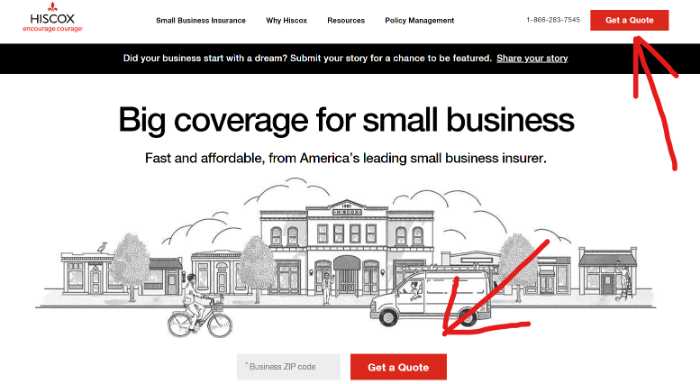

Get a quote online

To get a quote from Hiscox, you can either call them on the phone through their customer service number or visit their website as shown below. The quoting process is quick and easy, and you’ll be able to review the policy quote for your enterprise as soon as you complete the steps.

The landing page instantly gives you the option to get a quote and only asks for a few details to start.

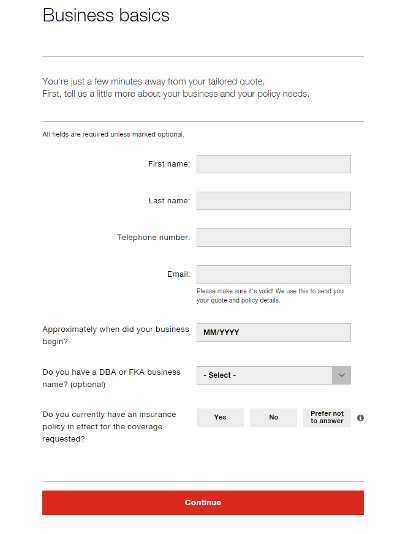

Upon clicking the button, you will be asked to define what type of work you do, your structure, and when you would like your policy to be effective.

You can then review and have your coverage tailor-made for your operations, services, and products.

4. Lastly, you are to enter your information, and voila! You have a policy review quote.

Hiscox Insurance Review Policy Benefits

Hiscox General Liability Insurance

Continuing with our review, SMBs encounter a slew of hazards on a daily basis, some of which may result in significant losses. This is where general liability insurance (GLI) comes in.

GLI is designed to protect the insured from third-party claims of bodily injury or property damage. It can also provide business coverage for damages that occur due to your product or service. This type of policy is essential for any owner, as it can help to reduce the financial burden of an accident or lawsuit.

For example, let’s say that a customer in a convenient store trips and falls over a step ladder in your store, and they decide to sue you for damages. If you have this type of policy, it will pay for their medical bills, as well as any other damages instead of paying for these expenses out of pocket.

Another example is if one of your products causes damage to someone’s property. Let’s say you installed piece of machinery, and it malfunctions and severely damages the garage door of a customer. If you’re found liable for the damages, a quick review of your general liability policy reveals the repair costs are covered.

Hiscox Business Owners’ Policy Insurance

In addition to general liability, Hiscox also offers a business owners’ policy (BOP). This type of policy combines several different types of coverage into one convenient package.

Typically, a BOP will include general liability, as well as property and business interruption insurance. This can be a great option for small operations that want to simplify their protection.

One of the benefits of a BOP is that it can save you money on premiums. When you bundle your policies together, upon review, you’ll often qualify for a discount from your insurer. This can help to reduce the cost of your overall premiums.

What is more, a BOP provides comprehensive protection for your company. If something happens that isn’t covered by your general liability policy, the other types of policies in your BOP will be useful.

For example, let’s say that a fire destroys your office building. If you have a BOP, your property protection will help to pay for repairs or replacement. And if your company is forced to close while the repairs are being made, your business interruption insurance will help to cover lost income.

As you can see, a BOP offers comprehensive protection. If you’re looking for an all-in-one solution, this type of policy is worth a thorough review.

Hiscox Professional Liability Insurance

Professional liability insurance, also known as errors and omissions (E & O), is designed to protect professional services businesses from claims of negligence. Especially if you provide services or products to your customers, this type of policy can help to protect you in the event something goes wrong.

Let’s review a few examples. If an accountant botches a client’s taxes or a consultant recommends a course of action that causes a company to lose money, their errors and omissions policy will cover some of the legal costs if they get sued.

What Factors Determine the Cost of Business Insurance?

Moreover, our review uncovered that the cost of insurance will vary depending on several factors concerning your business.

Generally, businesses located in high-risk areas or that work with dangerous materials will pay higher premiums than companies in low-risk industries. Also, companies with more employees will pay higher rates than those with fewer employees.

How Much Does Hiscox Business Insurance Cost?

Your business insurance policy from Hiscox will depend on the specific options you choose, as well as the size and location of your enterprise. On their website, they write that most small business owners spend about $30 a month for GLI, but you could get a policy review quote by following the steps already shown above.

Meanwhile, although Hiscox business insurance is a fairly priced option, it’s always a good idea to review and compare quotes from multiple providers before making a decision.

Now that you know a little more about the advantages Hiscox, check out these testimonials to help you make an informed decision.

Hiscox Customer Reviews

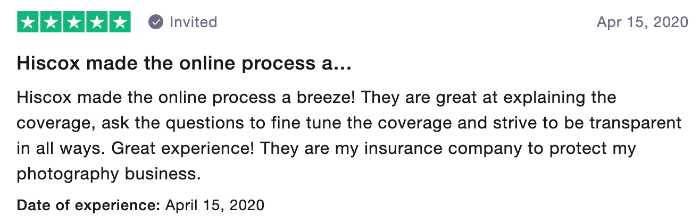

Below are some customer reviews and comments from people who got their business insurance and shared their experience with Hiscox:

A photographer left this glowing review of it’s online procedure. The photographer’s company had a wonderful experience with the insurer, especially during the claims process. The Hiscox agent did an excellent job at making policies understandable and readily changeable for first-time buyers.

Beyond their streamlined quoting process, a clients review shows their happiness about being able to speak with a Hiscox business insurance agent for matters beyond claims and inquiries.

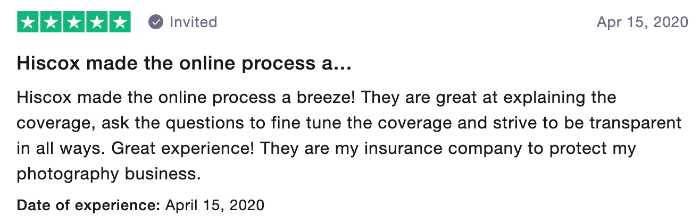

Complaints about Hiscox

Above is an account of a customer’s negative review experience with Hiscox. The customer runs a growing home inspections business who’s real estate transactions are not covered under his policy. This business owner’s dissatisfaction is understandable.

What is Hiscox’ Rating?

Hiscox insurance company has an excellent rating from the Better Business Bureau, and they are accredited by the BBB. They have been in the industry for over 100 years, and they are one of the leading companies serving businesses in the United States.

Making a Claim with Hiscox

If you need to file a claim with Hiscox, you can do so by visiting their website or calling their customer service phone number. Hiscox has a very simple and easy claims process, and they are usually very quick to review claims.

You will need to provide some basic information about your business and the incident that occurred, and then Hiscox will investigate the claim and make a decision. In most cases, you will be able to get a decision on your claim within a few days.

3 More Small Business Insurance Providers You Should Consider

In addition to Hiscox, there are a few other insurers worth considering. Here are three more providers that offer comprehensive coverage at competitive prices:

What is Next Insurance for Small Business?

Next is an insurance company that specializes in providing coverage for small businesses. They too offer a wide range of options as does Hiscox.

Yet, one of the things that sets Next Insurance apart from other providers is its online quoting system. This makes it quick and easy to get a quote to review. In addition, the company offers a variety of discounts to help keep their prices competitive.

Overall, Next Insurance is a great option for consultants, contractors, photographers, and many other professions that are looking for comprehensive coverage at a great price. If you’re interested in learning more about their policies or getting a quote, you can visit their company site or call their customer service number.

Is Hiscox or Next Insurance better for your business?

Hiscox and Next Insurance are both great choices. They both offer comprehensive protection at competitive prices. However, there are a few key differences uncovered in our review between the two companies that you should be aware of.

First and has been mentioned, Hiscox has been operating for over 100 years, while Next Insurance was founded in 2016. This means that Hiscox has more experience in the industry and a better reputation.

Second, Hiscox offers a wider range of choices than Next Insurance. This includes coverage for things like property damage, product liability, and workers’ compensation.

Third, Hiscox is available in all 50 states, while Next Insurance is currently only available in 26 states.

What is Thimble Insurance for Small Business?

Thimble is an insurance company that specializes in providing coverage for small businesses. They offer a wide range of coverage options, including BOP, professional liability, drone insurance, and more.

One of the features that distinguishes Thimble from other insurers is its emphasis on technology. Their online platform makes it quick and easy to get a quote and purchase a policy. In addition, they offer a mobile app that allows you to manage your policy and submit claims from anywhere.

Overall, Thimble is a great option for entrepreneurs that are looking for comprehensive coverage and a convenient way to review and manage their policy. If you’re interested in learning more about their policies or getting a quote, you can visit their website.

How does Hiscox compare to Thimble small business insurance?

Hiscox and Thimble are both excellent choices. They both offer comprehensive protection at competitive prices. However, there are a few key differences between the two that you should be aware of.

Thimble has less industry experience than Hiscox. This means that Hiscox has a better reputation and more clout with insurance carriers. Second, Thimble only offers limited coverage alternatives, whereas Hiscox provides a wider selection of protection policies to choose from.

What is Simply Business Insurance?

Simply Business is an company offering insurance policies for small biz owners. They offer a wide range of coverage options, including public liability , professional indemnity, business interruption insurance, and more.

From our review research, what sets Simply Business apart from other providers is its online quoting system. This makes it quick and easy for potential customers to get a quote. In addition, they offer a variety of discounts to help keep their prices competitive.

Overall, Simply Business is a great option for small outfits that are looking for comprehensive coverage at an affordable price. If you’re interested in learning more about their policies or getting a quote, you can visit their website or call their customer service number.

Can Simply Business Insurance Compete With Hiscox?

Hiscox is a large, well-established insurance company that offers a wide range of coverage options for customers to review. Simply Business is a smaller company that specializes in providing online quotes and discounts to entrepreneurs.

Overall, Hiscox is the better choice if you’re looking for comprehensive coverage and a long history in the industry. However, Simply Business is a great option if you’re looking to purchase an affordable policy and the convenience of online quoting.

The Bottom Line

Insurance is critical for protection. Hiscox offers a variety of coverage options that are customizable and allows you to get a free online quote in minutes. The process is simplified and will give you the peace of mind that comes with knowing you are fully insured.

Thanks for reading our review on Hiscox Insurance!